stamp duty act malaysia

For the purposes of Section 43 and Item 27 of the First Schedule the First Schedule to the Stamp Act 1949 of Malaysia the Credit Agreement shall be deemed to be a principal instrument and security to secure the payment of a a foreign currency loan denominated in US. At least two documents will attract stamp duty in a conveyancing transaction.

Exemption Of Stamp Duty And Capital Value Tax Cvt Through Finance Act 2020 Revenue Estate Department

Updated guidelines on relief from stamp duty pursuant to Sections 15 and 15A of the Stamp Act 1949 SA The IRB has published on its website updated Guidelines in Bahasa Malaysia on the application for relief from stamp duty under Sections 15 and 15A of the SA as follows.

. On 31 December 2021 the Malaysian Government announced that a maximum stamp duty of RM1000 would be imposed on securities traded on Bursa Malaysia for a five-year period from 1 January 2022 to 31 December 2026. In any other case more than 6 months RM100 or 20. West Malaysia -- 5 December 1949.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now. Stamp duties are imposed on instruments and not transactions. For other information please click and visit.

The general rule is that stamp duty assessable on loan amount excluding the insurance coverage MRTA or MRTT. The Order provides that instruments of service agreements Note that are chargeable under Item 221a First Schedule of the SA will be subject to stamp duty at a rate of 01 ie the. The Sale and Purchase Agreement.

This means that effective 1 January 2019 the stamp duty rate that is applicable for any instrument of transfer of a property that is valued in excess of RM1 million has been increased from 3 to 4. All instruments chargeable with duty and executed by any person in Malaysia shall be brought to the Collector who shall assess the duty chargeable. Malaysia imposes stamp duty on chargeable instruments executed on certain transactions.

For this purpose the Collector may require the instrument to be fully furnished with all other necessary or supporting documents of evidence. The transfer of shares will attract stamp duty at the rate of 03 on the consideration paid or market value of the shares whichever is the higher. By way of gift or love and affection.

When the instruments are executed outside Malaysia they must be stamped within 30 days after they have first been received in Malaysia. Garis Panduan Permohonan Pelepasan Duti Setem Di Bawah Seksyen 15 Akta Setem 1949. RM3 for each RM1000 or a fraction of them depending on the consideration or higher value.

Of the amount of the deficient duty. An Act relating to stamp duties. Item Description of Instrument Proper Stamp Duty 66 Laws of Malaysia ACT 378 4 Being the security for payment or RM1000 repayment of money made for the purpose of pursuing higher education in higher educational institutions.

Of the amount of the deficient duty. Instruments executed in Malaysia which are chargeable with duty must be stamped within 30 days from the date of execution. Our Alert on this announcement can be read here.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. In Malaysia the Securities Commission is responsible for implementing guidelines for regulating mergers acquisitions and takeovers involving public companies. A 428 was gazetted on 25 November 2021 and is deemed to have come into operation on 28 December 2018.

The Malaysian Stamp Act 1949 which is one of the oldest pieces of tax legislation in Malaysia is modelled in part on the United Kingdoms Stamp Act 1891. However the Stamp Duty Remission No. If the instrument is stamped later than 3 months but not later than 6 months after the time for stamping.

2 Order 2018 PU. Short title and application 1 This Act may be cited as the Stamp Act 1949. Stamp duty is one of the unavoidable costs in property purchase in Malaysia.

Penalty The penalty imposed for late stamping varies based on the period of delay. The Act Section 52 of the Stamp Act 1949 The Act stipulates that the instruments specified under the First Schedule of the Act must be duly stamped by the Inland Revenue Board of Malaysia IRB in the manner specified under Section 40 and Section 47 of the Act to enable the instruments to have a complete legal effect by being admissible in court as evidence. In general stamp duty is applied to legal commercial and financial instruments.

5 Being the security for securing the The same duty as a payment for the provision of services LEASE. Following the above the Stamp Duty Remission Order 2021 PU. Under the Stamp Act stamp duty is tax payable on the written documents during the sale andor transfer of a real property.

RM550000 include MRTA RM50000 RM550000 RM500000 RM50000 MRTA sum RM500000 x 05 RM2500 The total stamp duty payable on the loan sum is RM2500. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. East Malaysia -- 1 October 1989 Unannotated Statutes of Malaysia - Principal ActsSTAMP ACT 1949 Act 378STAMP ACT 1949 ACT 3781Short title and application Part I PRELIMINARY 1.

By way of sale and purchase or without monetary consideration ie. To give effect to the announcement of 31 December 2021 the Stamp Duty Remission. The formula is loan sum x 05 Example.

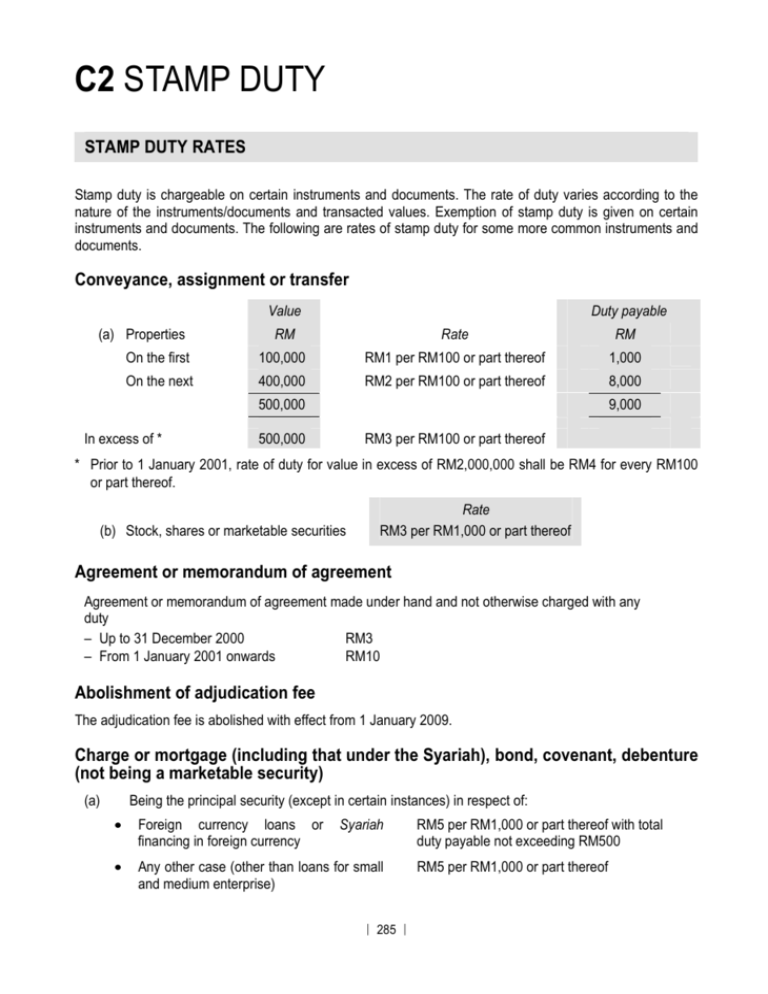

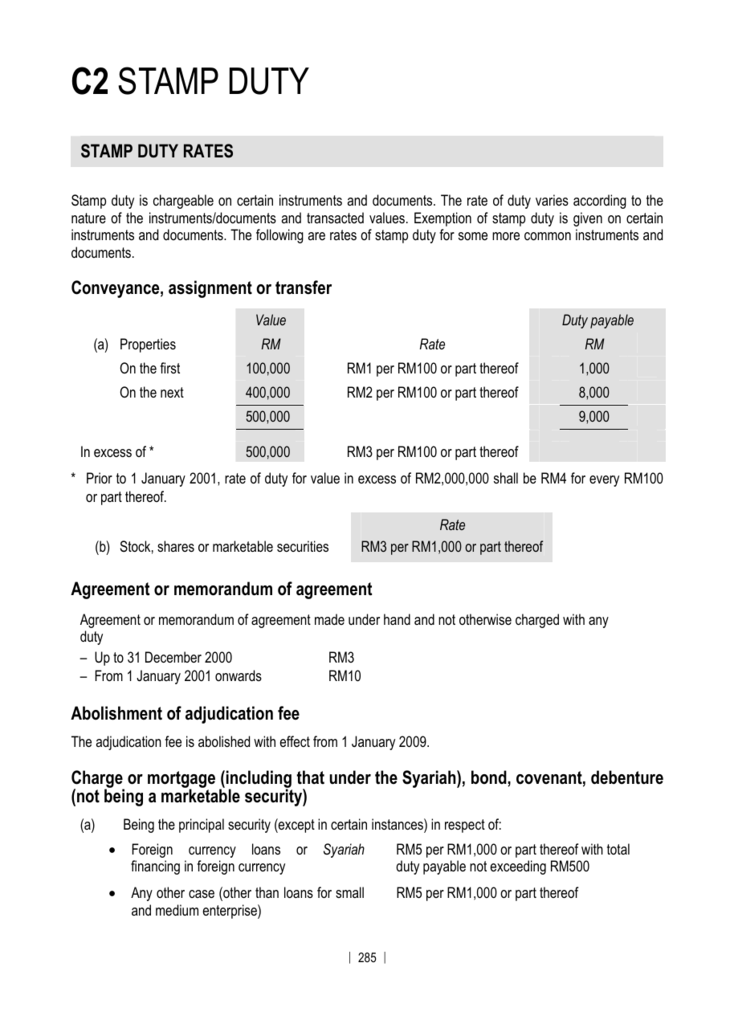

Pursuant to Stamp Act 1949 as amended by the Finance Act 2018 which came into effect from 01012019 the rate of stamp duty payable for transfer of properties in Malaysia is calculated as follows whether with monetary consideration ie. Consideration sum or the market value of the property whichever higher Stamp duty rate pre-amendment Stamp duty rate post-amendment First RM 100000 1 1 RM 100001 RM 500000 2 2 RM 500001 RM 1000000 3 3 RM 1000001 and above 3 4 Instruments falling under Item 221 in the First Schedule. Malaysian Stamp Duty Declaration.

Notwithstanding that various amendments have been made to the Malaysian Stamp Act over the years the language of the Act at times may not lend itself readily to current business practices. Of the amount of the deficient duty. However stamp duty relief is available for the following circumstances subject to meeting the pre-requisite.

Stamp Act 1949 Stamp Act which imposes stamp duty on various instruments. In Malaysia stamp duty is a tax levied on a large number of written instruments defined in the First Schedule of Stamp Duty Act 1949.

C2 Stamp Duty The Malaysian Institute Of Certified Public

Gift Deed Drafting Registration Stamp Duty Tax Implication Faq

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

C2 Stamp Duty The Malaysian Institute Of Certified Public

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Mm Tax Alerts Myanmar Stamp Duty Penalty Reductions Kpmg Cayman Islands

Evidentiary Value Of Unstamped Insufficiently Stamped Docs

Ws Genesis E Stamping Services

Stamp Duty And Contracts Yee Partners

An Analysis Of The Registration Requirements Of A Payable Stamp Duty Ipleaders

1 Nov 2018 Budgeting Inheritance Tax Finance

Malaysian Stamp Duty Handbook 6th Edition Marsden Professional Law Book

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

No comments for "stamp duty act malaysia"

Post a Comment